The Fed is starting to talk about tapering, which basically means less propping up of the economy. Since the pandemic hit, the Fed has been doing primarily two things:

Lowered the “Fed funds rate” which is the rate for banks when borrowing money from the Fed to lend to people. They’ve lowered it 1.5% and it has bounced between 0 and 0.25%. The idea here is that the lower the rate, the lower the rate passed on to the borrower, and the greater the possibility that the bank will lend. This should stimulate the economy.

Securities Purchase: Mainly US Treasury Bonds and Mortgage-backed securities. They have been buying 80 billion a month. That’s a lot if you needed context.

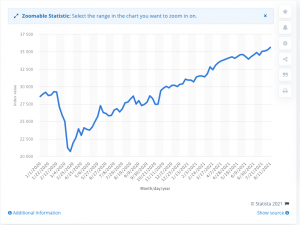

Now, on the good news front – this has worked. Some say too well. More on that later. The market (obviously) freaked in March of 2020. On March 15th of 2020, the market dropped 11% or nearly 3,000 points. That’s also a lot if you needed context.

Since then the markets have kind of gone bananas. Bad news comes out and the markets say, “No worries, we’ve got Uncle Feddie backing us.” Good news comes out and the market says “See? We’re on our way to recovery.”

Here is a chart that reflects that:

So, why all the preamble? Here is why:

These next few months are going to be critical for how we exit this financial tightrope we’re on. The Fed has to slowly back away from the table and “taper” how much they are supporting the economy. Pull back too fast and we could see a steep decline. Pull back too slowly and you’ve got an overly frothy market poised for a crash from unrealistic heights. Some argue that we’re already there.

When the Fed started the pullback in 2013 from the 2008 recession, we had a rocky year. The markets were scared of losing Uncle Freddie’s wallet and a big sell-off (some would say “panic”) ensued.

The Fed has learned from that experience in 2013 and will apply it to this tapering. But be ready for some volatility as we move towards it.

HERE is a very good (albeit technical) article on exactly what happened and where we are today. It’s an interesting read if you have the time.