When looking at recent data on the residential resale market, I like to pay attention to new home construction, mostly because they have much more control. We don’t actually have any influence on when someone decides to list their home (residential resale numbers), so it can be more difficult to dig out that data.

The new home sector spends all day trying to figure out where the housing market is headed. They make billion-dollar bets on where it’s headed, however, they have control over how many permits they start, how many homes they start, and even some control on the number of home completions since they can make things speed up or slow down as they decide is right.

There can be some good leading indicators for the residential resale market to be found in the new home data. Here is a quote from one of the monthly reports I look at:

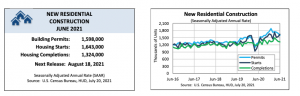

“Single-Family Permits Drop to Lowest Level in Nearly a Year: Single-family permits equaled a seasonally-adjusted annualized pace of 1.063 million in June, down 6% sequentially. This marks the lowest absolute level since August 2020 and is down 16% from January’s near-term peak. On a year-over-year basis, June’s 25% growth rate was down from 51% in May.”

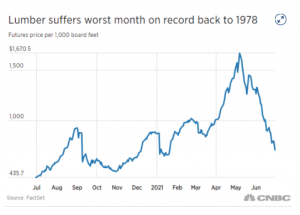

These reports caught my attention because as the supply chain came back online, construction prices seem to be normalizing. Lumber alone was down 40% in June. However, this response isn’t translating to lower prices at Home Depot just yet since this is the beginning of the supply chain, but new home builders tend to look “long-range.”

These reports caught my attention because as the supply chain came back online, construction prices seem to be normalizing. Lumber alone was down 40% in June. However, this response isn’t translating to lower prices at Home Depot just yet since this is the beginning of the supply chain, but new home builders tend to look “long-range.”

In short, I expected to see an increase in permits as costs started to normalize, but they’re going down. So, what gives?

The homebuilder response would be that supply constraints remain significant, backlogs are already large, and no need to incrementally press the gas on permits until the constraints ease up more and the machine can catch up. The “Uncle Keith” response would be that the data is another indication of demand cooling off on the margin. If builders were 100% confident in the demand environment and outlook, then you’d think they would be pulling as many permits as they possibly could, yet the annualized pace of permit activity is down pretty sharply from January’s peak.

The important part is in the margin. No need to panic here, just one more indicator that buyer fatigue is setting in, the market is slowing, and in the end that is probably a healthy thing for our industry and the future homebuyer.