I’ve been having a “sense” that inventory is creeping up. It’s been all antidotal with seeing a few price reductions on some various real estate searches I always have running, hearing stories about the five offers instead of the twenty-five offers, things like that.

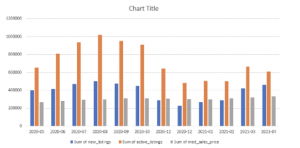

I mentioned this in passing with a friend at SmartZip and he sent this over to me a day later. The blue is the number of new listings and the orange is the number of active listings. As you can see, both are trending up in the last 60 days.

As we hit the end of the school year and summer begins (at the moment of this writing my little one is in a Zoom classroom in a blanket fort), the real estate market normally takes a breath. People’s lives get busy with transitioning from a school schedule to summer and often the real estate search takes a pause. I think that can be a factor.

Also, I have been saying for a while now, “The cure for high prices is… high prices.” It’s safe to say that values were rising at a record pace, and when they go up that fast for that long, sometimes the market (the buyer in this case) needs to pause, step back, and adjust/get used to the new situation.

Lastly, for the non-real estate people who follow me: I know you think we love a “hot market” but let me assure you that we don’t love it when the market is this out of balance. It’s heartbreaking to tell your buyers again (and again, and again) that they’ve lost their offer. To show them houses and have them fall in love with them only to get beat. All of us want a more normalized real estate market.

So is that where we’re headed? In my opinion no… not yet. Inventory levels are still far too low. Yes, inventory is somewhat on the rise, but when you’re on the floor the only way forward is up. I mean, inventory cannot go to zero. We need to see if it is a sustained trend line or the summer stall. Personally, I think a summer stall, but I would love to see things more normal for the overall health of the real estate market and the mental health of buyers.